The recent spate of Crypto Asset Service Provider (CASP) licences issued by the Financial Sector Conduct Authority (FSCA) has injected new energy into the crypto arbitrage market.

“The FSCA’s licensing regime has had a beneficial effect on the crypto industry, and crypto arbitrage in particular,” says actuary and CEO of Future Forex, Harry Scherzer.

“We campaigned long and hard for a licensing regime that would weed out the bad actors and give the market comfort that they are dealing with regulated entities. We were among the first to be granted a CASP licence, and since then, we have seen a major change in attitudes from investment houses, family offices and private investors seeking a low-risk, above-market investment opportunity.”

Crypto arbitrage involves purchasing crypto assets abroad and selling them in SA at a profit. Due to SA’s exchange controls, the scarcity of foreign exchange means that crypto assets typically sell at a 2-3% premium in SA relative to overseas exchanges. Crypto arbitrage providers such as Future Forex can capitalise on this to generate a profit for clients. Crypto arbitrage has become a huge industry in SA, having attracted a loyal and growing following among investors seeking low-risk, above-market returns.

“This is no longer an investment for those that are more risk-hungry, but for savvy individuals, and has recently drawn far more attention from financial advisors and wealth managers who understand how the trade works, the potential returns and the ability to leverage this opportunity on behalf of their clients,” adds Scherzer.

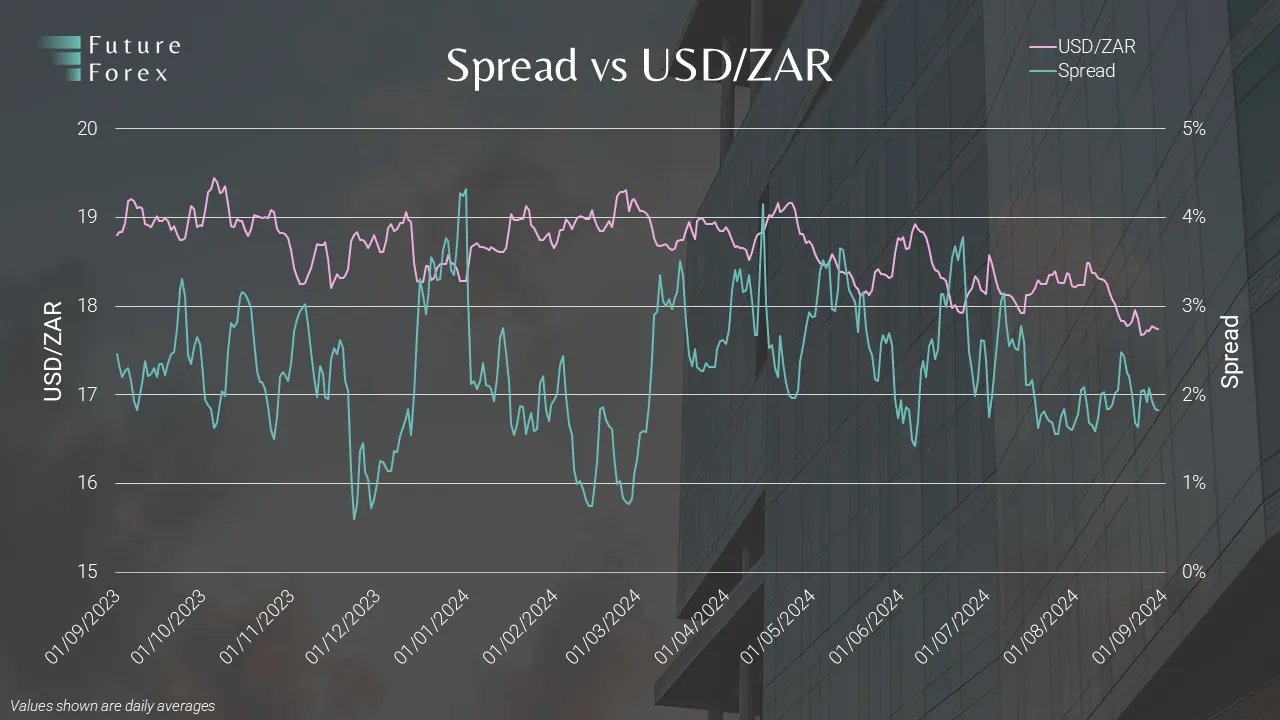

The chart below shows the USD/ZAR exchange rate (in purple) tracked against the crypto arbitrage premium (in blue) over the past 12 months. There is a strong inverse correlation between the exchange rate and the arbitrage spread, which tends to rise when the rand strengthens.

Exchange controls mean that South Africans have access to R11 million a year to trade. Of this, there is an annual R1 million a year Single Discretionary Allowance (SDA) and an additional R10 million in the form of Approval of International Transfers (AIT).

South African Revenue Service (SARS) approvals are required for the AIT, which Future Forex handles on behalf of clients at no charge.

These funds are used to purchase crypto assets abroad and then sell them in SA for a profit – all on the same day, sometimes in just a few hours. Future Forex uses BTC and the US dollar-backed stablecoin USDC for arbitrage and can switch between the two, depending on which offers the better profit potential.

Hedged risks

A key reason for crypto arbitrage’s popularity is its relatively low risk. While direct investments in bitcoin (BTC) or other crypto assets involve betting on the direction of the asset, crypto arbitrage does not attempt to predict any price movements.

The main risks in crypto arbitrage are typically movements in crypto prices or the ZAR/USD exchange rate while the trade is underway. However, Future Forex hedges its crypto arbitrage trades so that profits are locked in at the moment the trade is executed. This hedging system ensures its clients aren’t exposed to these market risks.

That leaves third-party risks, such as the potential failure of a third party used to complete the trade, such as a bank or a crypto exchange, but Future Forex manages this by choosing the most reputable providers after performing extensive due diligence on them.

Future Forex has processed more than R32 billion over 116 000 trades and has never made a loss.

How crypto arbitrage compares to other investments

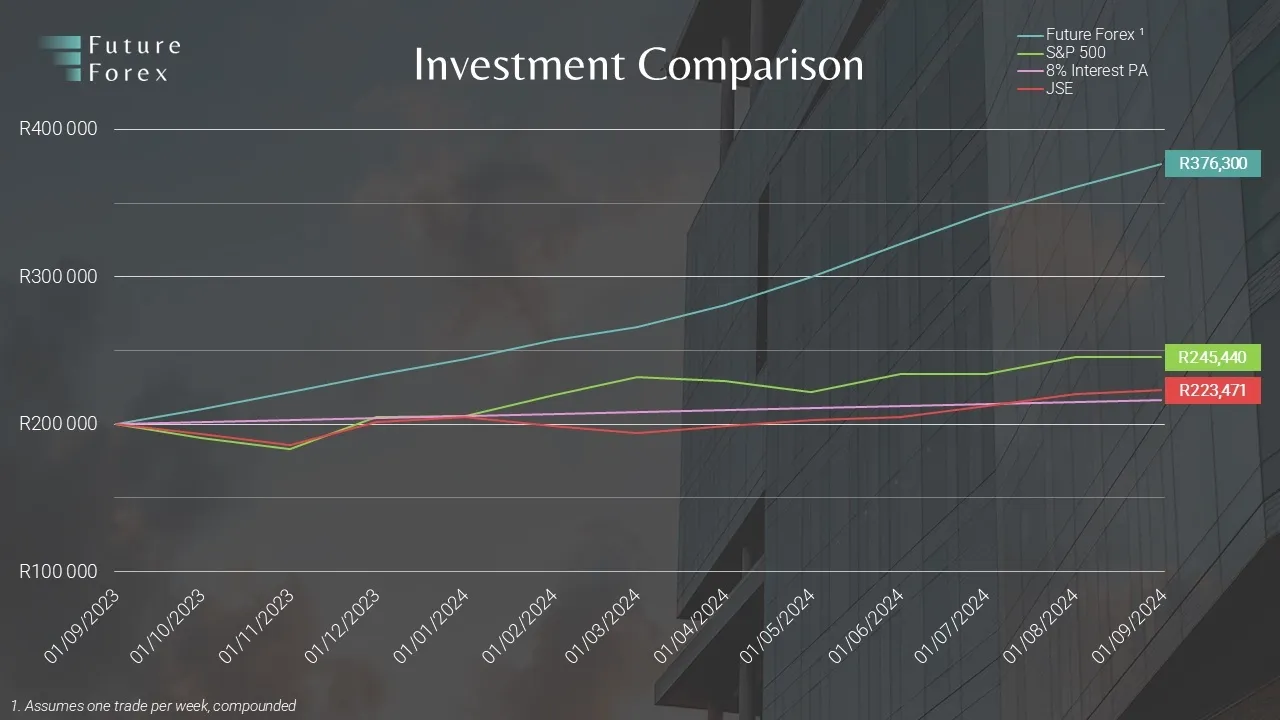

The chart below compares investment returns from crypto arbitrage, BTC, the JSE All Share index, the S&P 500 and an 8% annual interest account.

Crypto arbitrage offered the best returns by far, turning a starting capital of R200 000 into R376 300 over 12 months.

Relationship Managers

Future Forex assigns a dedicated relationship manager to each client to help them through the entire process, and to assist with any questions about arbitrage trading or tax.

“We also have a dedicated partnerships team for financial advisors and wealth managers looking to invest on behalf of their clients,” says Scherzer.

Online dashboard

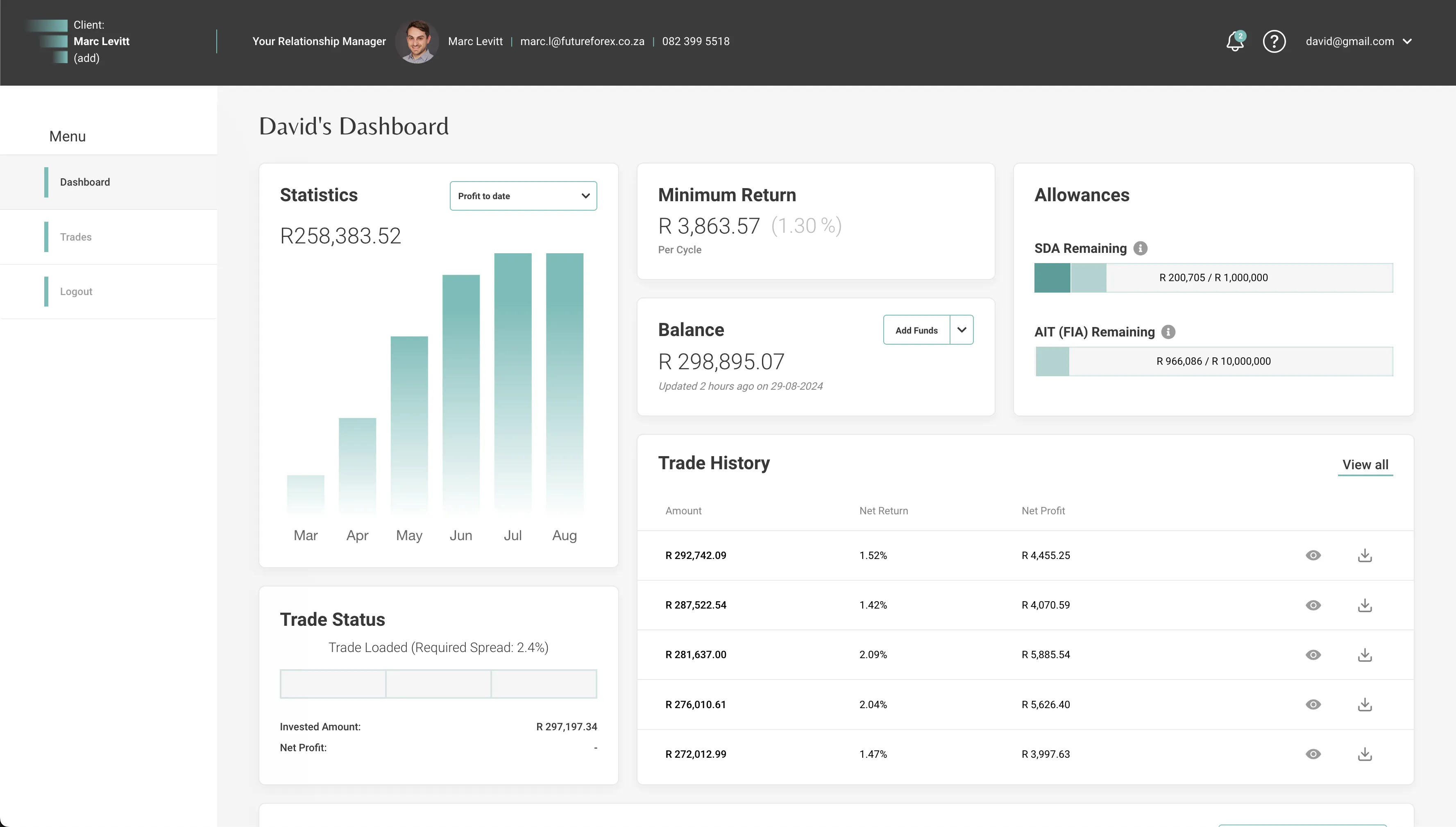

Clients receive access to an online dashboard for a real-time view of the progress on each trade, as well as the balance in the account.

Statements detailing the spread (gross profit), third-party fees, Future Forex fees, and the net profit and balance are emailed to clients, or their advisors, after each trade.

Who qualifies?

The minimum capital required for crypto arbitrage is R100 000, though R200 000 or higher reduces some of the fixed charges (such as SWIFT fees), making it more profitable for those with more capital to trade.

Costs

Future Forex shares in the profits after third-party costs, on a sliding scale of 25-35%, depending on the investment amount.

There are no other hidden fees or costs. This profit-sharing model ensures that the company’s interests are perfectly aligned with those of its clients.

“If our clients don’t make money, neither do we,” says Scherzer.

Register here.

For partnerships, email here for more information: [email protected]