Crypto arbitrage, once regarded as something of a cottage industry in SA, is quickly becoming a mainstream investment.

It involves purchasing and selling crypto assets in different countries to benefit from the price variances in these markets. For example, bitcoin (BTC) could be sold in SA this week for as much as 3.5% more than it costs in US and European exchanges. Thousands of South Africans have woken up to this relatively low-risk opportunity to boost their portfolio returns.

Future Forex, an authorised financial services provider (FSP), was one of the first crypto companies to receive its Crypto Asset Service Provider (CASP) licence from the Financial Sector Conduct Authority (FSCA) earlier this month.

“This is without doubt a huge milestone for the crypto industry in SA,” says Harry Scherzer, qualified actuary and CEO of Future Forex.

“This is something we have been advocating for a long time, and we are delighted that the FSCA is now licensing the crypto sector. It gives consumers the comfort that they are dealing with a regulated entity which should weed out most of the bad actors that have attached themselves to the crypto market.”

“This will have a hugely positive impact on the industry, and that’s one reason why we are seeing crypto arbitrage going mainstream.”

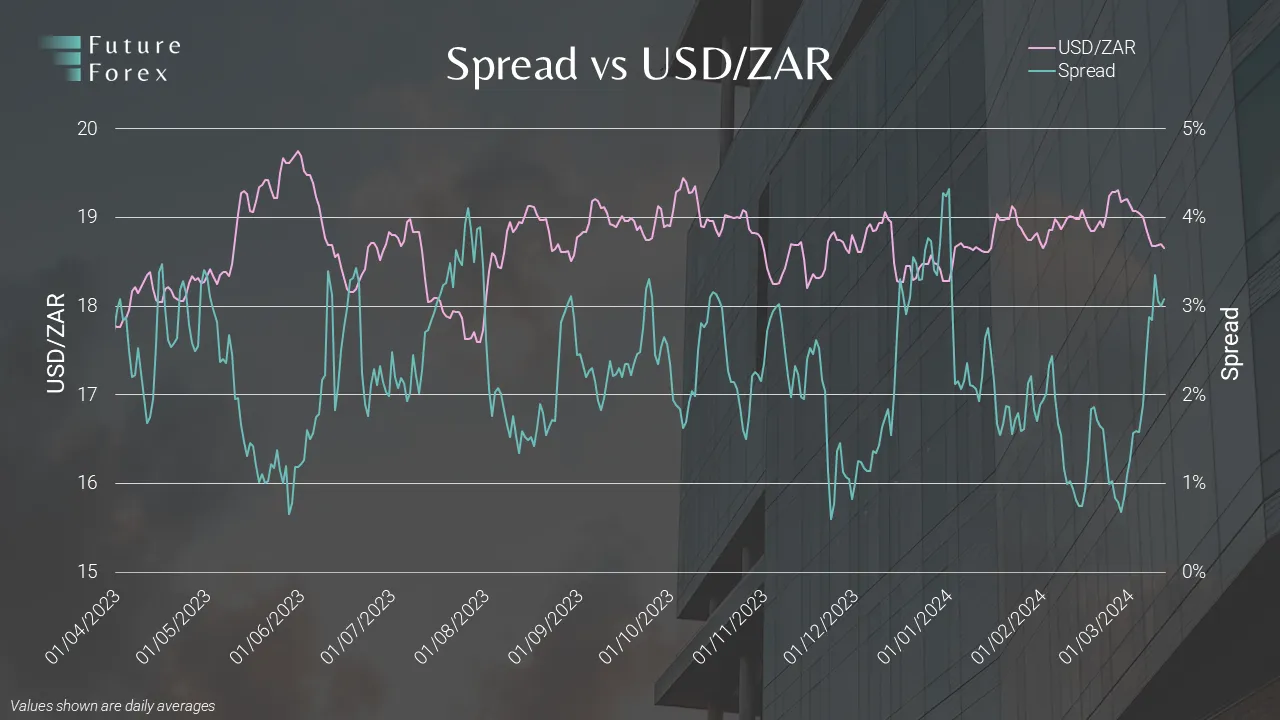

Another reason is the widening of the crypto arbitrage premium in SA, as shown in the graph below.

Scherzer explains that the widening arbitrage premium (or profit) is the result of a number of structural changes in the market, the most recent being the introduction of new SA Reserve Bank (Sarb) regulations disallowing the use of loans for individuals conducting crypto arbitrage. This has reduced the volume of funds flowing through the arbitrage market, thereby increasing the profit.

“In terms of new regulations, non-bank loans for individuals to use for arbitrage are no longer allowed, meaning individuals can only invest their own funds into arbitrage,” says Scherzer.

“At Future Forex, we have always ensured that clients use their own funds as dictated by regulation.”

“We welcome the decision to disallow the use of loaned funds as this further enhances the legitimacy of crypto arbitrage, increasing the sustainability and longevity of this highly lucrative investment.”

Regulations mean that South Africans have access to R11 million a year to trade. Of this, there is an annual R1 million Single Discretionary Allowance (SDA), for which no approvals are required, and an additional R10 million in the form of Approval of International Transfers (AIT). Sars approvals are required for the latter, which Future Forex handles on behalf of clients at no charge.

Reducing risks

Crypto arbitrage’s popularity stems from the fact that it is relatively low risk as it does not attempt to predict the price movement of assets. Instead, the aim is to buy a crypto asset such as bitcoin (BTC) or a US dollar stablecoin like USDC on an overseas exchange and then sell it in SA at a profit.

The key risks in arbitrage trading are typically crypto price movements or changes in the ZAR/USD exchange rate while the trade is underway. However, Future Forex hedges its crypto arbitrage trades so that profits are locked in at the moment the trade is executed. In doing so, this ensures that clients aren’t exposed to any market risks.

That leaves third party risks, such as the potential for failure of a third party used to complete the trade (such as a bank or a crypto exchange), but Future Forex manages this by choosing the most reputable providers after performing extensive due diligence on them, says Scherzer.

Future Forex has never made a loss on a single trade in more than R23 billion processed in over 85 000 trades.

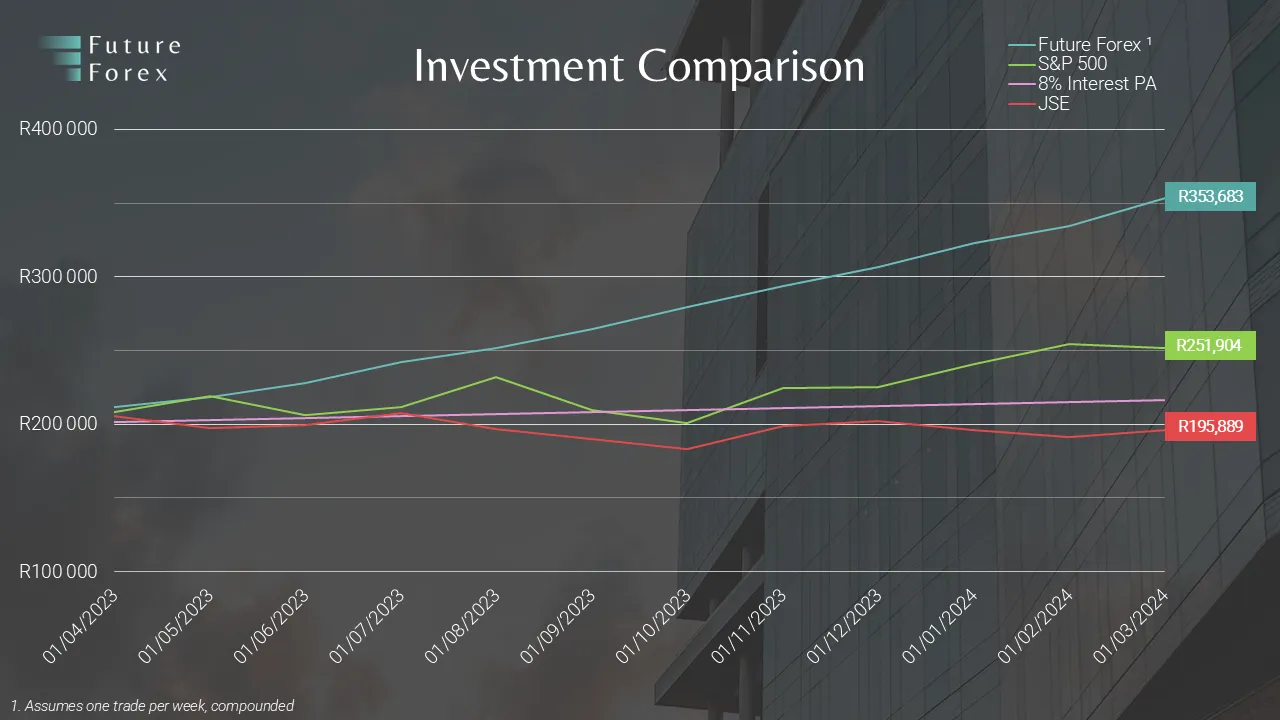

Investment comparison

The chart below compares investment returns from crypto arbitrage, the JSE All Share index, the S&P 500 and an 8% annual interest account. Crypto arbitrage offered the best returns by far, turning starting capital of R200 000 into R353 683 over 12 months.

Relationship Managers

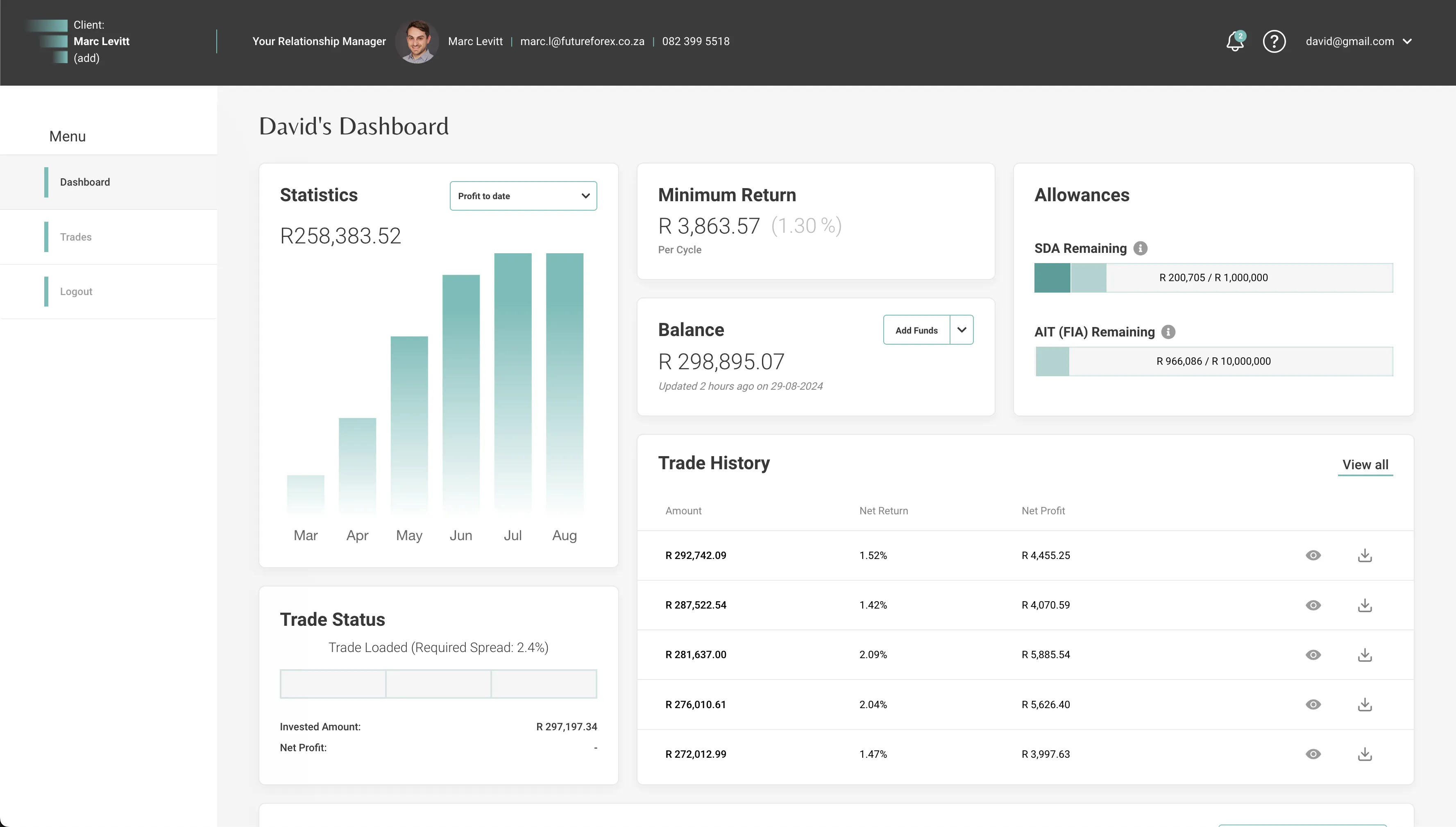

Future Forex assigns a dedicated Relationship Manager to each client to help them through the entire process, and to assist with any questions about arbitrage trading or tax.

Clients also have access to an online dashboard for a real-time view of the progress on each trade, as well as the balance in the account.

Statements are emailed to clients after each trade, detailing the spread (gross profit), third party fees, Future Forex fees, net profit, and balance.

Who qualifies?

The minimum capital required for crypto arbitrage is R200 000, although the higher the investment, the higher the returns will be. This is because certain fixed charges (such as SWIFT fees), decrease as a percentage of the total amount invested.

Costs

Future Forex shares in the profits on a sliding scale of 25-30% depending on the investment amount. There are no other hidden management fees or costs.

“This profit-sharing model means clients’ interests are perfectly aligned with those of the company,” says Scherzer. “If our clients don’t make money, neither do we.”

Register here.