The banks’ hidden costs

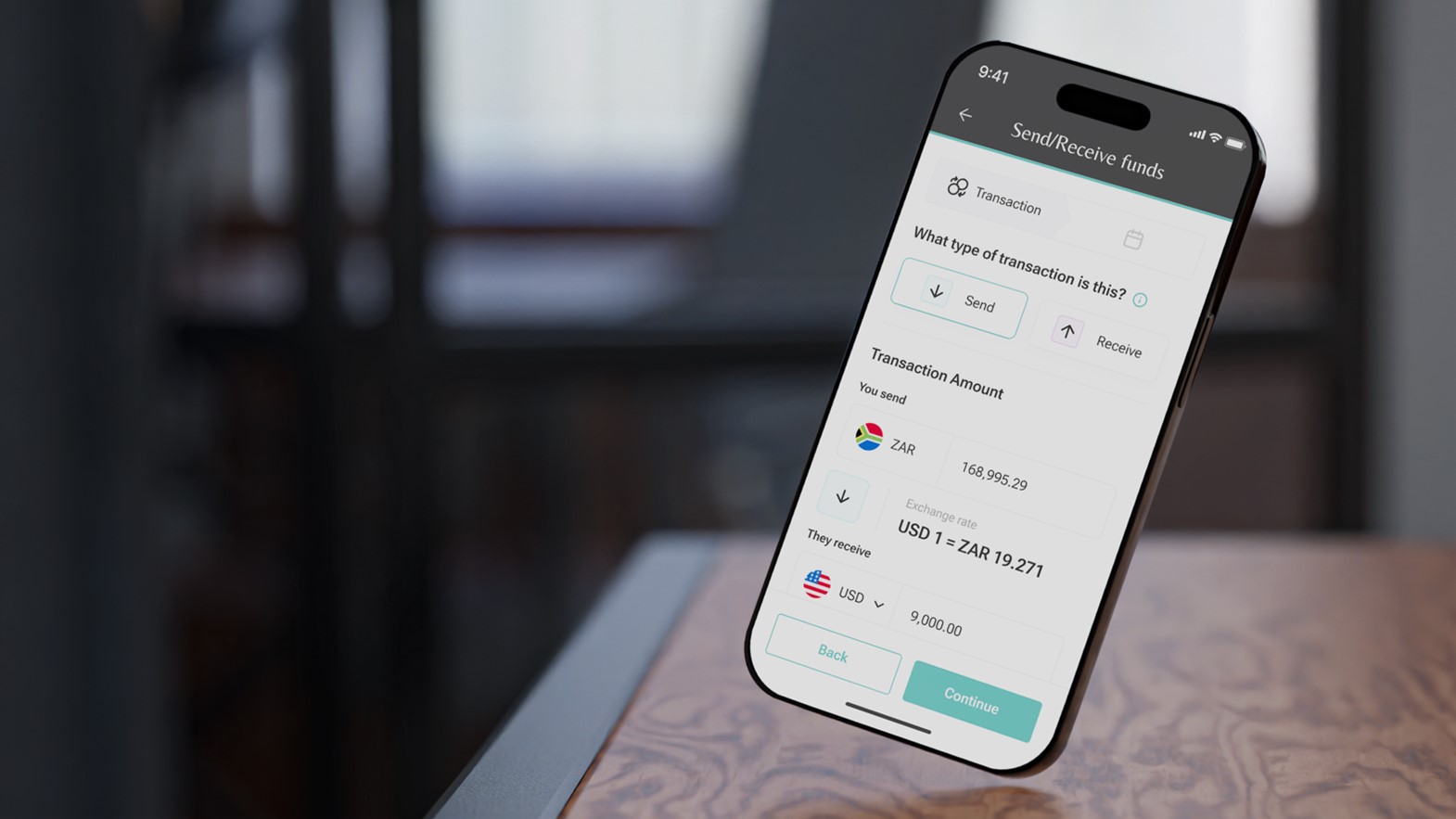

Banks are not always upfront about the actual cost of international money transfers. In many cases, fees are buried into the exchange rate itself, a practice known as the spread fee. At first glance, it may appear that the only cost of an international money transfer is the SWIFT or processing fee, which typically ranges from R500 to R1000. However, the real hidden expense lies in the exchange rates offered by banks. Instead of providing competitive market rates, many banks impose significant margins, meaning they profit substantially at the expense of their customers.

Outdated systems and processes

Many banks still rely on manual systems, resulting in delays, transfer errors, and limited transparency. Hidden costs you never knew were there can add up significantly on larger transfer amounts, ultimately leaving you with less than you expected on the other side. On top of this, their lack of agility increases the risk of human error and can cause severe complications with delayed or reversed transactions.

Inaccessible or limited customer support

For most banks, international money transfers are just one of many services they offer. They tend to prioritise high-value corporate clients in this space, which means individuals and SMEs often need more guidance and support with problem resolution.

If you’ve ever tried to resolve an issue with a transfer, you’ll know how challenging it can be to get prompt and effective help. This lack of service can leave you feeling like a mere number in the system, like dealing with a home affairs office, especially with complex transactions.

Why look for alternatives?

Given these challenges, it’s worth exploring alternatives to banks for your international money transfer needs. Here are some key reasons why:

-

Transparent Pricing: Many non-bank providers offer clear upfront fees and competitive exchange rates, so you know exactly what you’re paying.

-

Speed and Efficiency: With automated systems and streamlined processes, alternative providers, like Future Forex, can complete transfers more swiftly than traditional banks.

-

Better Customer Experience: International money transfer specialists focusing exclusively on cross-border payments, import/export transactions, foreign investments, and emigration provide tailored solutions and expert-led guidance to meet your specific needs seamlessly, cost-effectively, and without hassle.

Making the switch without leaving your bank

Shifting services away from your bank might seem daunting, but the process can be seamless with the right partner by your side. And to top it off, you can still stay with your bank for your day-to-day financial needs. Future Forex offers tools and educational resources to help you make informed international money transfer decisions while providing complimentary compliance services. Think of it as your VIP pass to the services usually reserved for a select few.

Choosing the right international money transfer solution can save you time, money, and unnecessary frustration. Be sure to explore alternatives so that your hard-earned money works harder for you - no matter where it’s going. For more information on how tech startups are outpacing traditional finance, read Harry Scherzer, our CEO of Future Forex opinion on Fintechs vs traditional banks: how tech upstarts are outpacing traditional finance.