Some of South Africa’s foremost investment thinkers have long advised that people living in the country hold as much of their wealth offshore as possible. Understandably so too. Over the past decade or so, the S&P 500 has outperformed the JSE All-Share Index by a significant margin.

Investing offshore can also act as a hedge against a weak Rand. This has benefits if you choose to stay in South Africa because you’ll likely end up with more money than you would even if local investments were doing well. If, on the other hand, you’re thinking of moving overseas at some point in the future, your money can start working for you long before you actually move.

In either scenario, you’ll want to maximise the returns you get. While I’m not in a position to offer investment advice, there are a few things related to foreign exchange transactions and regulatory compliance that can make a big difference if you get them right.

1. Know how much you can invest annually

Before moving any of your investments offshore, it’s important to know how much you can move across. In the past, exchange controls meant that South Africans were limited in how much they were able to invest offshore. More recently, those controls have been relaxed (to the extent that even pension funds can now invest up to 45% of their money offshore).

Individuals can now take R1 million a year out without any approvals. Having obtained the right approvals from SARS, known as an AIT (Approval of International Transfers), they can take a further R10 million a year out of the country without restrictions. Typically, tax practitioners and financial advisers can assist with this but will charge a hefty fee. Try to find a forex provider, like Future Forex, who will assist with the application free of charge.

It is also possible to take more than R11 million offshore in a calendar year, but this requires special approval from the Reserve Bank.

2. Understand the fees involved

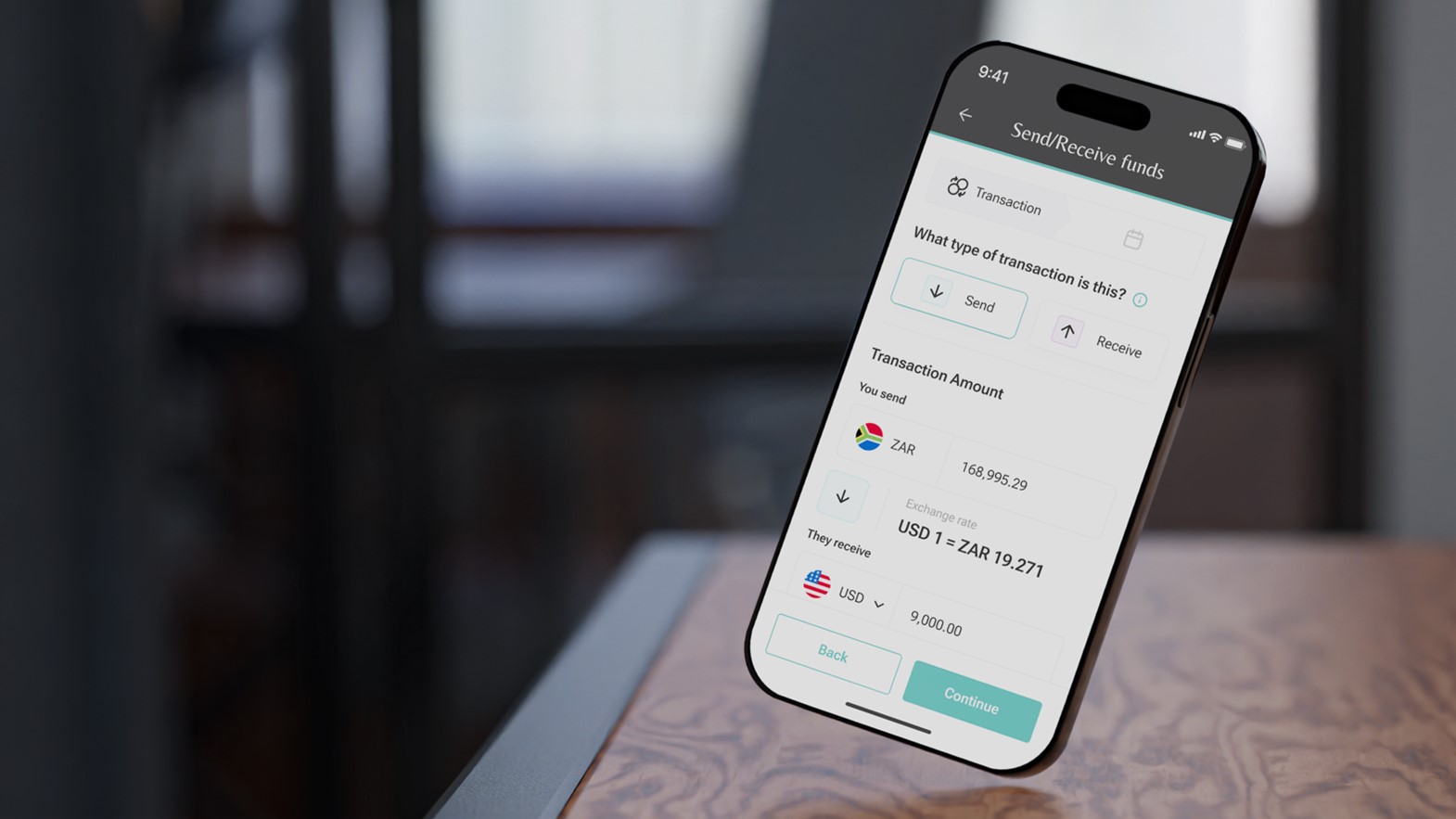

One of the most important things you can do before investing money offshore is to understand how foreign exchange fees work.

Most people who’ve done any kind of foreign exchange transaction will be familiar with the transaction fee, which can be charged as a set fee or a percentage of the total transaction. But there are other fees too. You might, for instance, encounter a commission fee (usually based on a percentage of the transaction amount) and account maintenance fees. However, the most significant fee to watch out for is the margin or “spread”, which you can read about next.

Understanding these fees can make it a lot easier to compare foreign exchange providers, ensure that you’re getting the best possible pricing, and make more money offshore.

3. Insist on transparency in the margin or “spread”

Potentially even more important than the fixed fees that banks and other forex providers charge is the exchange rate margin. Sometimes referred to as “the spread”, it’s simply the difference between the rate at which a forex provider buys a currency and the rate at which it sells it. All providers charge it, with many relying on it to make a profit. The trouble comes from the fact that many forex providers don’t do so transparently or consistently.

So, for example, if the spot price to the US Dollar is R18.72 but the bank charges you R18.92, you’re paying a little more than one percent. For a transaction of R100 000, that means you’re being charged just over R1 000 extra in fees. Make that a R1 million transaction and you’re paying north of an additional R10 000 in fees you might not even know about.

It’s therefore critical that anyone planning on investing offshore uses a forex provider that’s completely transparent and consistent about how it charges the exchange rate margin.

4. Watch the exchange rates

Unless you happen to be importing and exporting, working for an offshore company, or are planning an overseas holiday, chances are you don’t spend that much time thinking about exchange rates. But if you’re planning on investing offshore, it’s something you should keep a close eye on.

After all, as any investment professional will tell you, seemingly small amounts can make a big difference in the long run. This is especially important with currency exchange rates, where a few cents difference can translate to thousands of Rands being lost. It’s impossible to predict what exchange rates will do, but using a forex provider who has their finger on the pulse can help avoid sending your funds during high market volatility and help get the best bang for buck.

5. Diversify!

This is the one piece of investment advice I do feel comfortable giving. You can’t simply take your money offshore, put it in offshore unit trusts or listed property and assume that you’ll be better off than with a well-balanced portfolio in South Africa.

So, once you’ve got your money overseas make sure it’s diversified between different asset classes (cash, bonds, equity) and jurisdictions in line with your risk appetite.

Savings. Consistency. Transparency

Ultimately, anyone investing money offshore needs to remember that they’re taking positive steps towards securing their financial futures. The steps outlined above can help them do so before they even put a cent into their preferred investment products, especially if they partner with a forex provider that’s committed to savings, consistency, and transparency in pricing.